Key Employer Benefits

-

No disruption to existing plans

-

Boost retention and recruitment

-

Improve productivity through healthier employees

-

Help control healthcare costs

-

Enhance your total benefits package with minimal admin effort

Key Employee Benefits

-

Pre-tax premium deductions = more take-home pay

-

Unlimited 24/7/365 telehealth access

-

Up to 15 fixed indemnity benefits for unexpected events

-

Pharmacy coverage for 1,000+ medications

-

Weekly health education & wellness programs

-

Optional $100K whole life insurance

Want to learn more?

Connect with our benefit experts for a personalized consultation. We'll discuss your current benefit plans, answer your questions, and show you how our tailored solutions can help you save on insurance costs and achieve real results. Schedule your session today to take the next step toward growth.

Trusted by leading companies

“Utilizing the Capstone Health and Wellness plan (offers) shared benefits for the employees as well as the employer are bar none to any others we have researched"

Frequently asked questions

Does Capstone replace my current insurance?

No! Capstone does not disrupt or replace any medical or supplemental plan-- some business see declined health insurance costs.

It is an addition to your current benefits for qualified employees-- full-time, $25k+ salary.

How is this no-cost?

Capstone is a section 125 Pre-Tax plan-- Ex: instead of sending $100 to the IRS for payroll taxes you would keep that, send us $40 for the program, you keep $60.

-No-Net-Cost

What is the cost to my company for the Capstone Plus plan?

Although there are fees associated with enrolling in the Voluntary Group Medical Plan, there are no out-of-pocket expenses. The monthly compliance costs are $40 per employee from the company’s tax savings and $80 from the employee’s tax savings on average. When Capstone implements the payroll plan, the savings will be recognized immediately in the next payroll cycle, and Capstone will administer the fees 60 days after that.

What benefits are included in Capstone Plus?

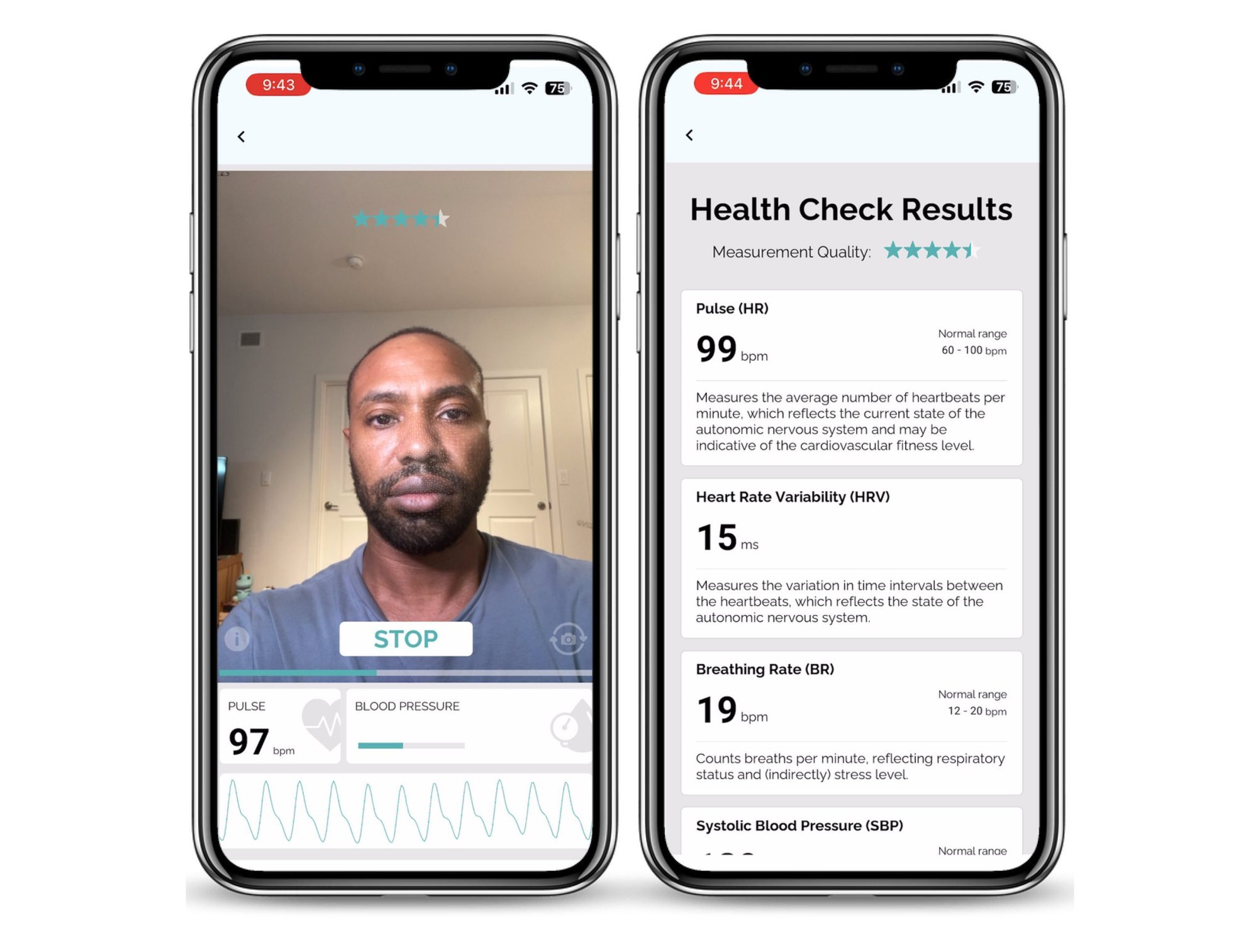

A voluntary, portable, guaranteed issue Supplemental Whole Life Insurance (with Cash Accumulation and Living Benefits) and Comprehensive Wellness Services, including:

- Unlimited Preventive Care

- Virtual Primary and Urgent Care

- TeleCounseling

- Not Cost Generic RX (Discounted Branded Med)

- Hospital Bill Eraser

- Cost of Care Navigation

- No Copays or Deductibles

In addition, Medical, Mental Health, and Dental support specialists are all available 24 x 7 x 365 by contacting the EAP hotline right from the app.

Which Insurance Company is providing the Supplemental Insurance Policy?

MassMutual, established in 1848, over 175 years ago. They have created this plan exclusively for Capstone.

What is the AB Rating for Capstone?

MassMutual is the only product in the HonorOne offering that requires this rating. Preventive programs like Amaze Health do not get rated. See https://www.massmutual.com/about-us/massmutual-financial-summary

How much cash value accumulates with the life insurance policy?

It varies and requires that the company know the following variables:

- Age of the insured when the policy is issued

- Gender of the insured

- Whether the insured is a nicotine user or not

- These policies have a guaranteed cash value build up.

- They also pay non-guaranteed dividends. 4% on average per year

What is the legislation that created the funds for this type of program?

The Prevention and Public Health Fund was established under Section 4002 of the Patient Protection and Affordable Care Act of 2010 (ACA) and made into law. Also known as the Prevention Fund or PPHF, it is the nation's first mandatory funding stream dedicated to improving our nation's public health system.

What happens to the Benefits and the Supplemental Life Insurance Policy if the employee leaves the employer?

Both the Capstone Benefits and the Supplemental Life Insurance Policy are portable. In the event employment is severed, the employee will be able to take them with them if they are willing to pay the premiums themselves. The Insurance Policy will retain any contribution value, and any growth value at that time.

What is a M.E.C. Plan?

M.E.C. (Minimum Essential Coverage) refers to plans designed to provide affordable and comprehensive healthcare coverage, ensuring that an employer meet the essential health benefits requirements under the Affordable Care Act (ACA). A MEC plan includes preventive and wellness services, routine check-ups, and screenings at no additional cost to the member. If an organization has 50 or more full-time employees, it's legally required to provide M.E.C. options fulfilling 2 requirements:

1. It must be affordable.

2. It must provide minimum value to full-time employees and dependents.

How does the Capstone Plus plan make money?

The initial compensation is funded by the insurance policy, while the residuals are funded by the benefit plan.